Do you want to find 'income assignment colorado'? You can find questions and answers on the topic here.

To prevent arrearages, Colorado employs something known as an "income assignment." Income assignments come when the Country sends a notification to your employer instructing it to withhold your baby support and progressive it to the Family Support Register.

Table of contents

- Income assignment colorado in 2021

- Changing child support colorado

- Colorado income withholding form

- Colorado state income withholding form

- Income assignment order form louisiana

- Income withholding order kansas

- Family support registry login

- Colorado court forms

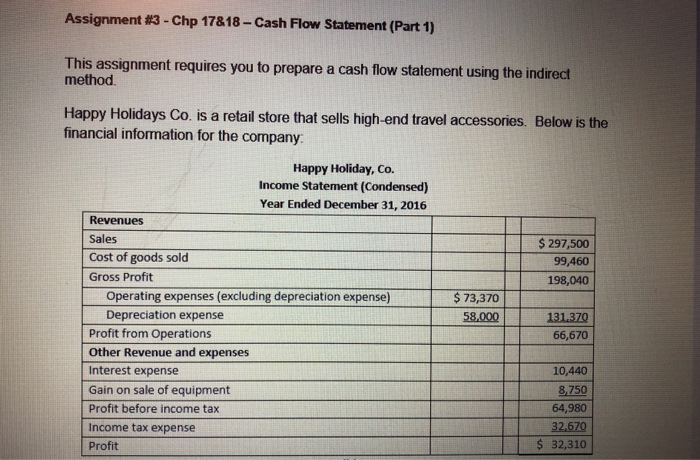

Income assignment colorado in 2021

This image representes income assignment colorado.

This image representes income assignment colorado.

Changing child support colorado

This image shows Changing child support colorado.

This image shows Changing child support colorado.

Colorado income withholding form

This image demonstrates Colorado income withholding form.

This image demonstrates Colorado income withholding form.

Colorado state income withholding form

This picture illustrates Colorado state income withholding form.

This picture illustrates Colorado state income withholding form.

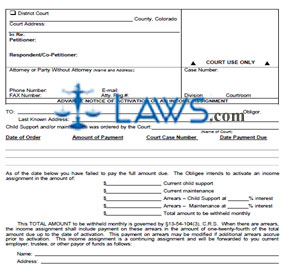

Income assignment order form louisiana

This picture representes Income assignment order form louisiana.

This picture representes Income assignment order form louisiana.

Income withholding order kansas

This image shows Income withholding order kansas.

This image shows Income withholding order kansas.

Family support registry login

This image demonstrates Family support registry login.

This image demonstrates Family support registry login.

Colorado court forms

This image representes Colorado court forms.

This image representes Colorado court forms.

Can a tip be used as an income assignment?

If an employer cashes out credit card or check tips to an employee on a daily basis, the employee’s disposable earnings that are subject to an income assignment may be insufficient to pay the obligee (the ex-husband or ex-wife) the amount required to be paid under the income assignment. For example:

Can a taxpayer assign income to a property?

A taxpayer cannot, for tax purposes, assign income that has already accrued from property the taxpayer owns. This aspect of the assignment of income doctrine is often applied to interest, dividends, rents, royalties, and trust income.

What is " assignment of income " under the tax law?

Specifically, the assignment of income doctrine holds that a taxpayer who earns income from services that the taxpayer performs or property that the taxpayer owns generally cannot avoid liability for tax on that income by assigning it to another person or entity.

What does the assignment of income doctrine mean?

Under the so-called “assignment of income doctrine,” a taxpayer may not avoid tax by assigning the right to income to another. Specifically, the assignment of income doctrine holds that a taxpayer who earns income from services that the taxpayer performs or property that the taxpayer owns generally...

Last Update: Oct 2021