Do you scour the internet for 'cima code of ethics'? You will find the answers here.

CIMA’s Code of Ethical motive requires members and students to e'er act with objectiveness. Section of the Code states that accountants must non “compromise professional operating theater business judgment because of bias, battle of interest surgery undue influence of others”. In this scenario, Mark appears to be oblation you a caper in return for getting him consultancy work with your employer.

Table of contents

- Cima code of ethics in 2021

- Cima code of practice virtues

- Cima ethics free ce

- Professional code of ethics examples

- Cima code of ethics summary

- Cima code of ethics integrity

- Cima code of ethics for professional accountants

- Acca code of ethics

Cima code of ethics in 2021

This picture demonstrates cima code of ethics.

This picture demonstrates cima code of ethics.

Cima code of practice virtues

This image illustrates Cima code of practice virtues.

This image illustrates Cima code of practice virtues.

Cima ethics free ce

This image illustrates Cima ethics free ce.

This image illustrates Cima ethics free ce.

Professional code of ethics examples

This image demonstrates Professional code of ethics examples.

This image demonstrates Professional code of ethics examples.

Cima code of ethics summary

This image shows Cima code of ethics summary.

This image shows Cima code of ethics summary.

Cima code of ethics integrity

This picture representes Cima code of ethics integrity.

This picture representes Cima code of ethics integrity.

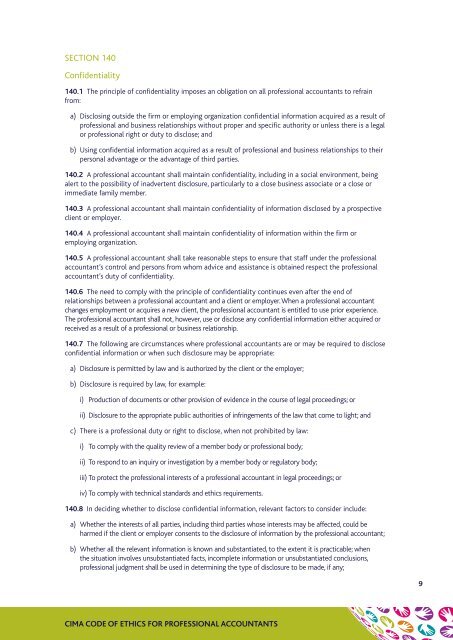

Cima code of ethics for professional accountants

This picture representes Cima code of ethics for professional accountants.

This picture representes Cima code of ethics for professional accountants.

Acca code of ethics

This image illustrates Acca code of ethics.

This image illustrates Acca code of ethics.

What are the principles of the Cima Institute?

CIMA upholds the aims and principles of equal opportunities and fundamental human rights worldwide, including the handling of personal information. The Institute promotes the highest ethical and business standards, and encourages its members to be good and responsible professionals.

When to report a matter to the Cima?

To ensure that CIMA members protect the good standing and reputation of the profession, members must report the fact to the Institute if they are convicted or disqualified from acting as an officer of a company or if they are subject to any sanction resulting from disciplinary action taken by any other body or authority.

What was part 2 of the Cima code of ethics?

Part 2 of the Code was developed in cooperation with the American Institute of CPAs (AICPA). The AICPA and CIMA joined together to create a designation for management accountants, the Chartered Global Management Accountant (CGMA).

What is the structure of the Code of ethics?

Structure of the Code Part 1 of the Code of Ethics lays out the conceptual framework and fundamental principles. Part 2 applies to professional accountants working in business, including all those holding the CGMA designation. Part 3 applies to professional accountants working in public practice.

Last Update: Oct 2021